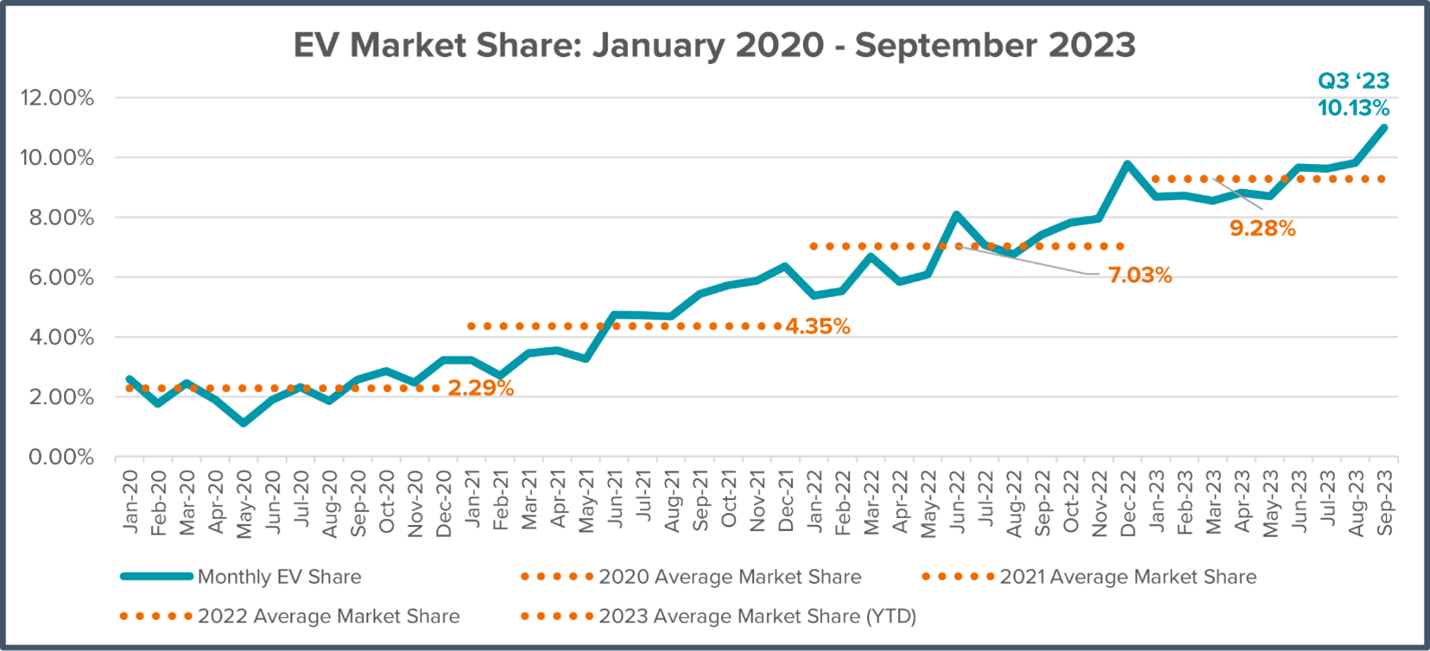

EVs: 10.1 percent of new U.S. light-duty vehicle sales in third quarter 2023 – 3 percentage points above same period 2022

111 electric models now available for sale in U.S. – light truck sales 74 percent of EV market

Charging infrastructure lags: only one new public charging port added per 48 new registered EVs

WASHINGTON, DC – Alliance for Automotive Innovation today released its exclusive state-by-state analysis of the U.S. electric vehicle (EV) market for Q3 2023.

The Get Connected Electric Vehicle Report for the third quarter summarizes EV sales and purchasing trends across all 50 states.

More EV models in market; sales up sequentially and year-over-year

- 111 EV cars, utility vehicles, pickup trucks and van models now available for sale in the U.S. in Q3 2023. Light truck sales represent 74 percent of EV market;

- EVs represent 10.1 percent of new light-duty vehicle sales in Q3 2023, up from 9.1 percent in Q2 2023 and 7.1 percent in Q3 2022;

- More than 378,000 EVs sold in U.S. in Q3 2023, a 63 percent increase over Q3 2022;

- Top five list for EV sales in Q3 2023: California (28.1 percent); Washington (21.7 percent); District of Columbia (19.3 percent); Colorado (17.9 percent) and Oregon (16.3 percent).

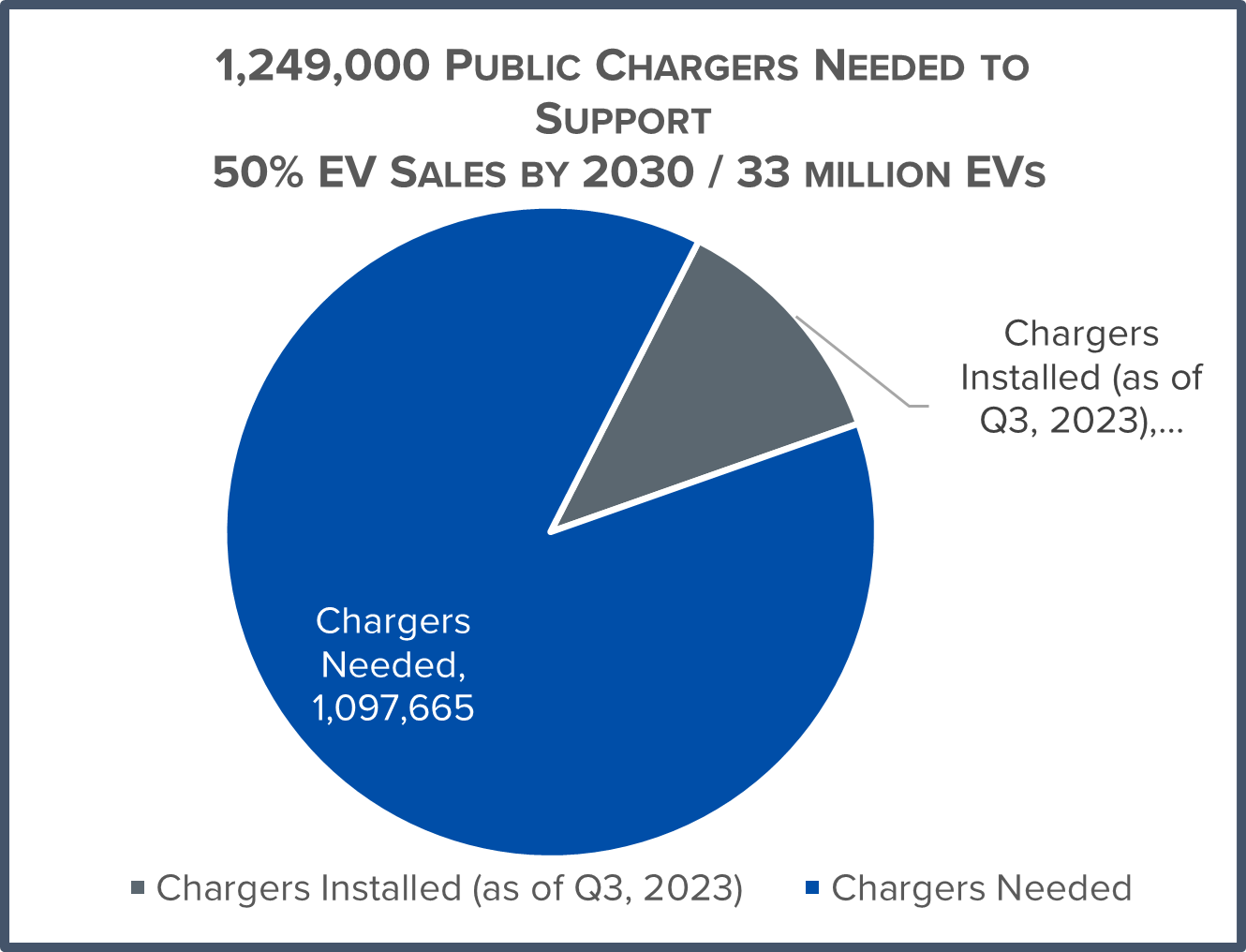

Public EV charging still lags

- Installation of U.S. public chargers is not keeping up with current and projected EV sales;

- In the first three quarters of 2023, the number of publicly available EV chargers increased 26 percent year-over-year – while EV sales increased 59 percent;

- Nationwide, 378,097 EVs were registered in Q3 2023 but only 7,800 new public chargers added – a ratio of 48 EVs for every new public port;

- There are 4 million EVs on the road and a total of 151,303 publicly available charging outlets in U.S. – a ratio of 26 EVs for every public port;

- Nearly 1.1 million more public chargers (950,000 Level 2 and 147,000 DC Fast) are required to meet the National Renewable Energy Laboratory’s necessary infrastructure estimate for 2030;

- Put another way, 414 chargers will need to be installed every day, for the next 7.2 years – or nearly 3 chargers every 10 minutes – through the end of 2030.

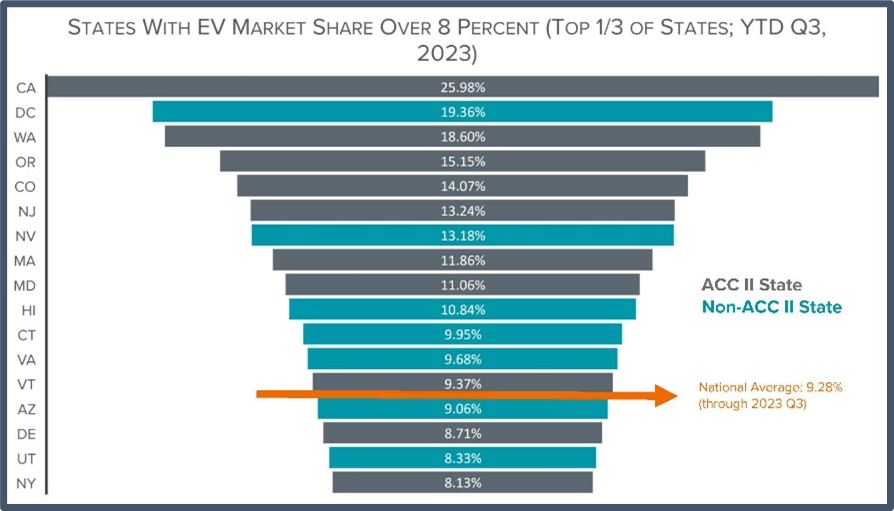

EV mandates alone do not move markets; every state is different

California and nearly a dozen other states have adopted the Advanced Clean Cars II regulation requiring 35 percent of auto sales to be zero-emission in 2026 and 100 percent in 2035.

- One-third of ACC II states have an EV market share below the national average of 9.28 percent for the first three quarters of 2023;

- Nearly as many non-ACC II states are above 8 percent EV market share (seven states) as there are ACC II states (nine states in addition to California);

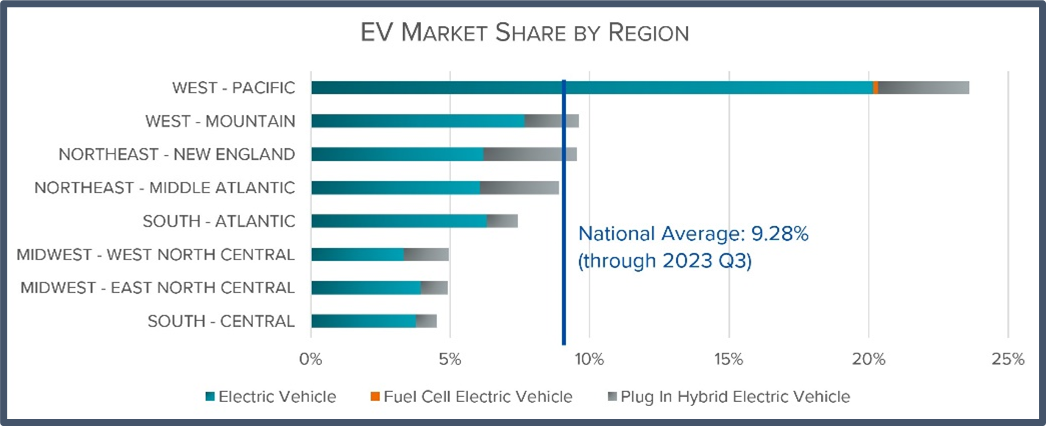

- Coastal regions in the west and east have higher EV market share rates than regions in the country’s interior;

- States in the top third median income bracket have three-times the EV market share of states in the lowest third income bracket;

- Of the states in the top third of EV sales (above 8 percent through the third quarter of 2023), 13 states were in the top income bracket, four were in the middle bracket and zero were in the lowest income bracket;

- Population density: states with a more urban population have more than twice the EV market share (10.6 percent) than more rural states (4.2 percent);

- Plug-in hybrids (PHEVs) are most popular in rural states: PHEV market share is 28 percent of all EV sales in rural states, while only 18 percent in urban states;

- Political affiliations: so-called “blue states” (that tend to vote Democratic in presidential elections) have more than three times the EV market share than “red states.” “Purple states,” or swing states, have half the market share of “blue states.”

Automakers and battery partners have committed $125 billion (so far) to expand the production of EVs and batteries inside the U.S. and across North America. A successful transition to electrification – and meeting government requirements – depends on factors outside the vehicle.

Read the full Q3 2023 Get Connected Electric Vehicle Report.

Sign-up to receive Get Connected EV reports HERE.