By Hilary Cain

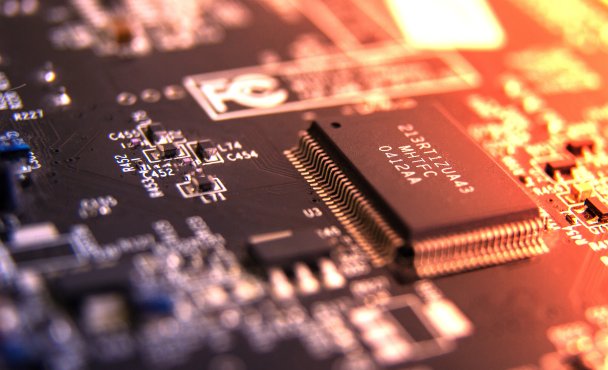

During the pandemic, the world realized how essential semiconductor chips are to modern automaking.

The meltdown that disrupted the global flow of semiconductor chips – and slowed auto manufacturing to a crawl – is mostly resolved. For now, at least.

But the automotive supply chain for semiconductor chips remains fragile.

The average car today contains more than 1,700 semiconductor chips. These chips support or enable a range of essential features and capabilities related to vehicle control, safety systems, power management, and information displays.

Beyond that, semiconductor chips are necessary for emerging vehicle technologies, including advanced driver assistance systems, automated driving systems, connected services and applications, software-defined capabilities, and new mobility models.

While leading edge and other advanced node semiconductor technologies are increasingly important to higher-level automotive functions, architectures, and technologies, the automotive industry – much like the defense, aerospace, and medical device industries – remains highly dependent on a range of foundational chips (sometimes referred to as “legacy” chips or “mature node” chips).

In fact, about 95 percent of chips used by the automotive industry are foundational chips. And this will continue to be the case for the foreseeable future. That’s because chips used in vehicles must be “automotive grade” – designed for much longer product lifecycles and capable of withstanding harsh conditions such as extreme temperature variations, moisture, dust, vibration, and electromagnetic interference.

Recent investments in foundational semiconductor manufacturing in the U.S. are helping to grow capacity and meet automotive demand. But automotive manufacturers in the U.S. are still largely dependent on other countries to manufacture and supply these automotive grade chips.

Enter China.

The Chinese Communist Party has made a strategic decision to invest heavily in semiconductor production and is targeting its investment to the production of, you guessed it: foundational chips.

China has a clear pattern and practice of ignoring intellectual property rights and using non-market activities to hollow out market-based competitors to gain dominance. If left unchecked, China could soon overproduce and eventually dominate foundational chip production globally.

The U.S. should respond by developing and implementing a focused and comprehensive strategy to increase domestic production of the foundational semiconductors needed by the auto industry. That strategy should include:

-

- Growing U.S.-based production of foundational semiconductors by providing financial assistance to private entities for the fabrication, assembly, testing, or packaging of foundational semiconductors. While the CHIPS and Science Act of 2022 provided $39 billion in funding to bolster semiconductor manufacturing in the U.S., the vast majority of that funding went to the production of advanced node chips. A comparable investment is needed to support foundational chip production.

- Strengthening existing incentives for U.S.-based semiconductor manufacturing by extending the advanced manufacturing investment tax credit under 48D beyond 2026 and expanding eligibility to include investments in chip design, used or refurbished manufacturing equipment, and upstream materials and components used in the manufacturing of semiconductors and semiconductor manufacturing equipment.

- Mitigating potential impacts to automotive production from supply chain disruptions by making zero or low interest loans or tax deductions available to automotive manufacturers and suppliers for the costs associated with building up “buffer” inventories of semiconductors or with scrapping such “buffer” inventories, if circumstances or needs change.

The U.S. should also implement policies that support research, development, and intellectual property creation related to foundational semiconductor chips. Leading improvements in the performance, efficiency, and capabilities of these semiconductor chips will help promote and sustain the global competitiveness of the U.S. in these critical automotive components.

And to foster resiliency and redundancy, the U.S. should enhance cooperation with global partners – through bilateral, regional, and multilateral agreements – for foundational chip production outside of China.

A healthy and competitive auto industry in the U.S. requires access to a resilient and trusted supply of foundational semiconductor chips.

To achieve that, rather than tariffs or other import restrictions, the U.S. needs significant investment in – and sustained commitment to – building additional domestic semiconductor production that meets the future needs of the auto industry.

It’s absolutely essential.

Hilary Cain is the Senior Vice President of Policy at Alliance for Automotive Innovation.