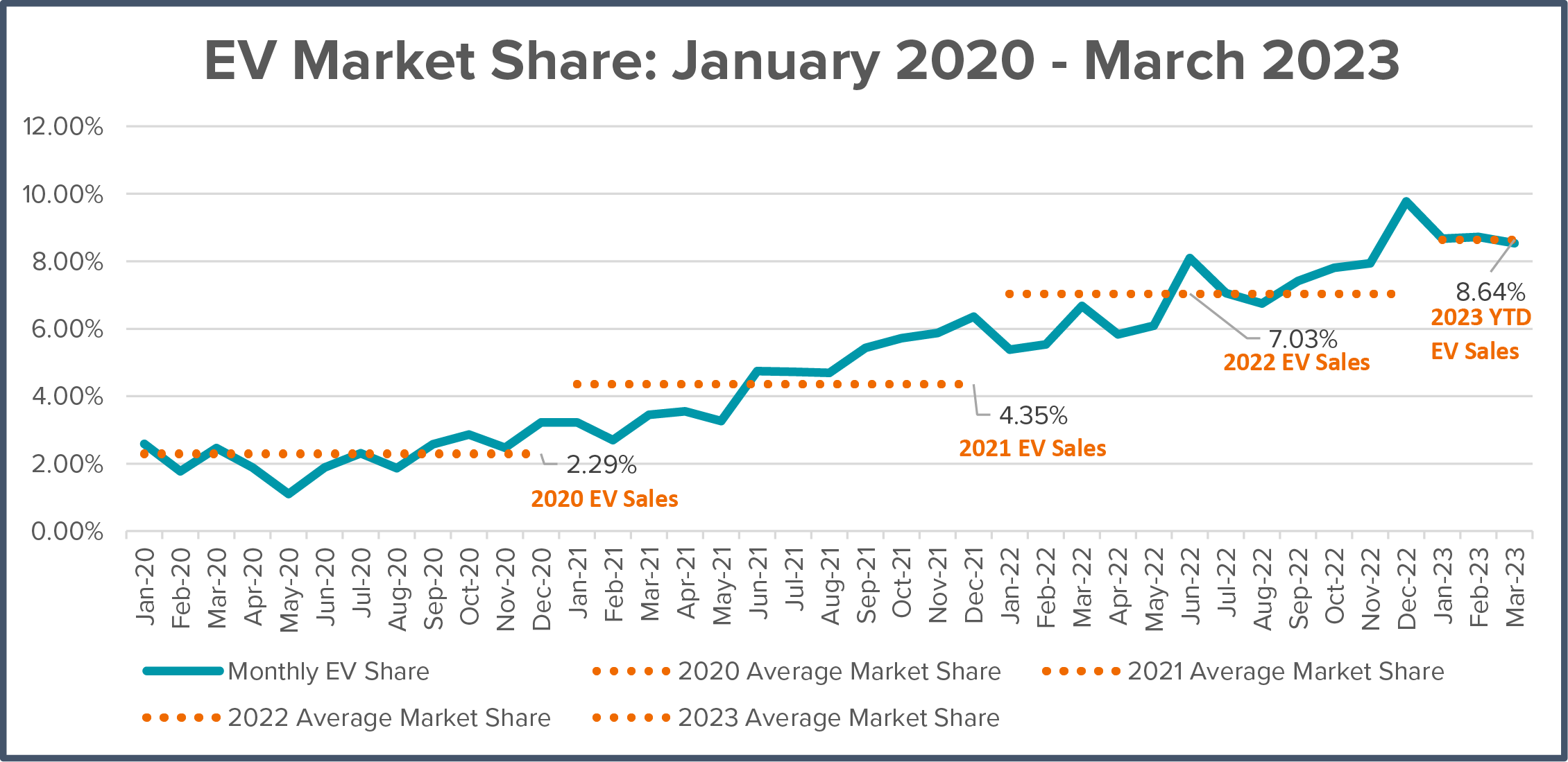

Electric vehicles: 8.6 percent of new U.S. vehicle sales in first quarter 2023 – 2.7 percentage points above same period 2022

97 electric models now available for sale in U.S. – light truck sales 73 percent of EV market

Warning signs: Public charging still lags demand; China dominates critical mineral and battery supply chains

WASHINGTON, DC – Alliance for Automotive Innovation today released its exclusive analysis of the U.S. electric vehicle (EV) market for Q1 2023. The Get Connected Electric Vehicle Report summarizes EV sales and purchasing trends across all 50 states. The report also includes a look at public charging and the availability of critical minerals and battery components necessary to manufacture EV batteries.

More EV models enter market; sales hold steady

-

Q1 2023: 97 EV cars, utility vehicles, pickup trucks and van models now available for sale in the U.S. Light truck sales represent 73 percent of EV market;

-

EVs represent 8.6 percent of new light-duty vehicle sales in Q1 2023, up slightly from 8.5 percent in Q4 2022 and 5.9 percent in Q1 2022;

-

More than 305,000 EVs sold in U.S. in Q1 2023, an increase of 56 percent over same period in 2022;

-

Top five list for EV sales in Q1 2023: California (23.9 percent); District of Columbia (20.1 percent); Washington (16.9 percent); Oregon (16.0 percent) and Nevada (14.9 percent).

Warning sign: public charging lags

Q1 2023 public charging data:

-

Installation of U.S. public chargers is not keeping up with current and projected EV sales;

-

Total of 133,982 publicly available charging outlets in U.S. for 3.34 million EVs on the road, a ratio of 25 EVs per charger;

-

305,047 EVs registered in Q1 2023 and only 7,802 new chargers added – a ratio of 39 EVs for every new public port;

-

The number of Level 2, DC Fast public EV chargers increased 31 percent year-over-year (from 101,946 in Q1 2022 to 133,925 in Q1 2023).

Warning sign: not enough domestic or IRA compliant minerals and battery components

Automakers and battery partners have committed $115 billion (so far) in electrification and domestic battery cell manufacturing and announced plans to build nearly two dozen battery factories in the U.S. over the next few years.

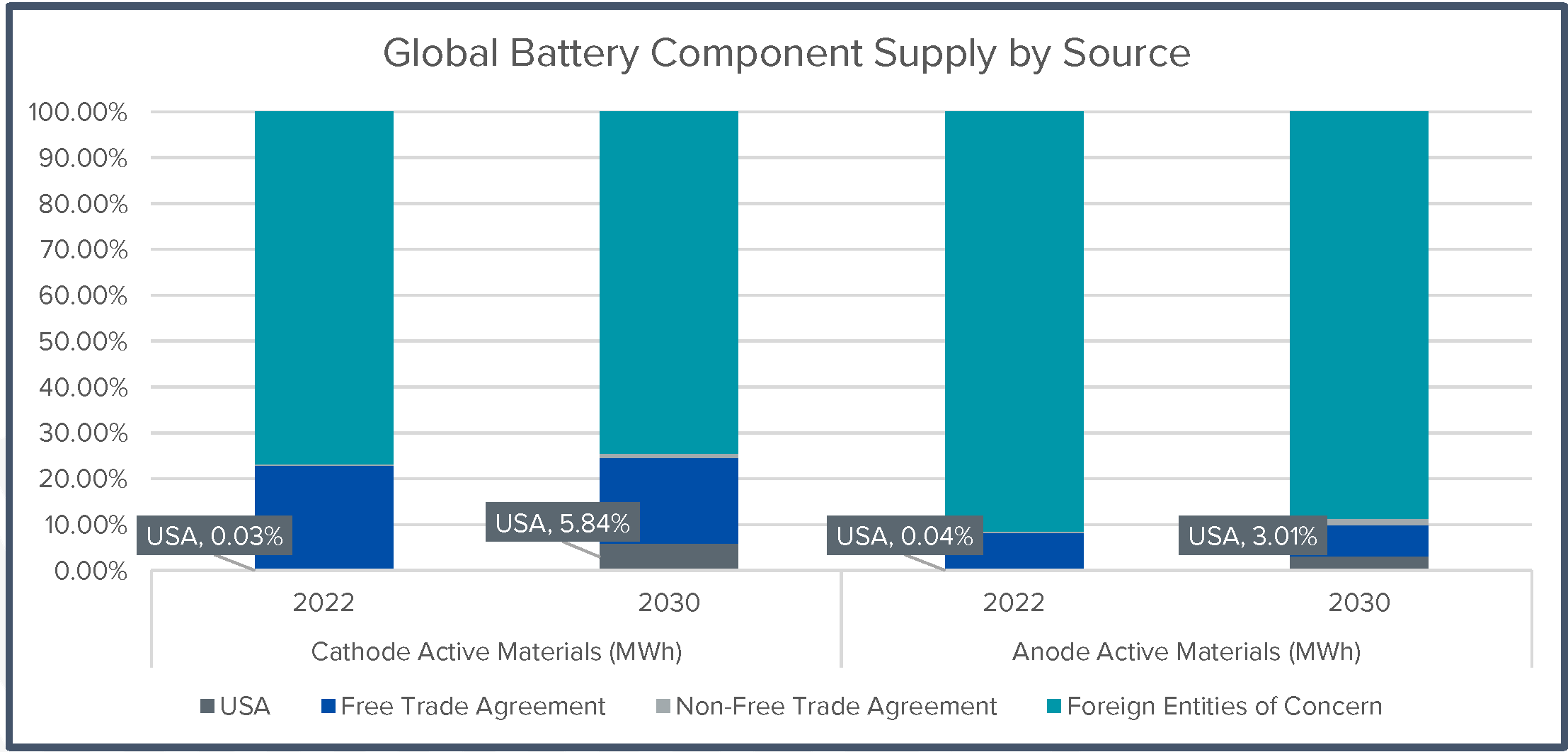

While capacity to manufacture battery cells is increasing, Benchmark Minerals forecasts a lack of upstream (mining) and midstream (processing and cathode/anode production) capacity to supply new battery facilities with necessary materials.

-

China (designated as a foreign entity of concern) is predicted to remain the largest producing country for cathode active materials through at least 2040;

-

China has over 90 percent of the world’s anode production capacity and will continue at that rate through 2030, despite global efforts to diversify the supply chain;

-

U.S. imports 100 percent of its graphite, the mineral used for battery anodes. Almost one-third comes from China. China also converts over 90 percent of the world’s graphite into anode material;

-

China currently controls more than 71 percent of the world’s nickel sulphate manufacturing.

Automakers have committed more than $115 billion to expand the production of EVs and batteries inside the U.S. and across North America.

Read the full Q1 2023 Get Connected Electric Vehicle Report.

Sign-up to receive Get Connected EV reports here.